Why Should You Choose A Fee-Only Fiduciary Advisor?

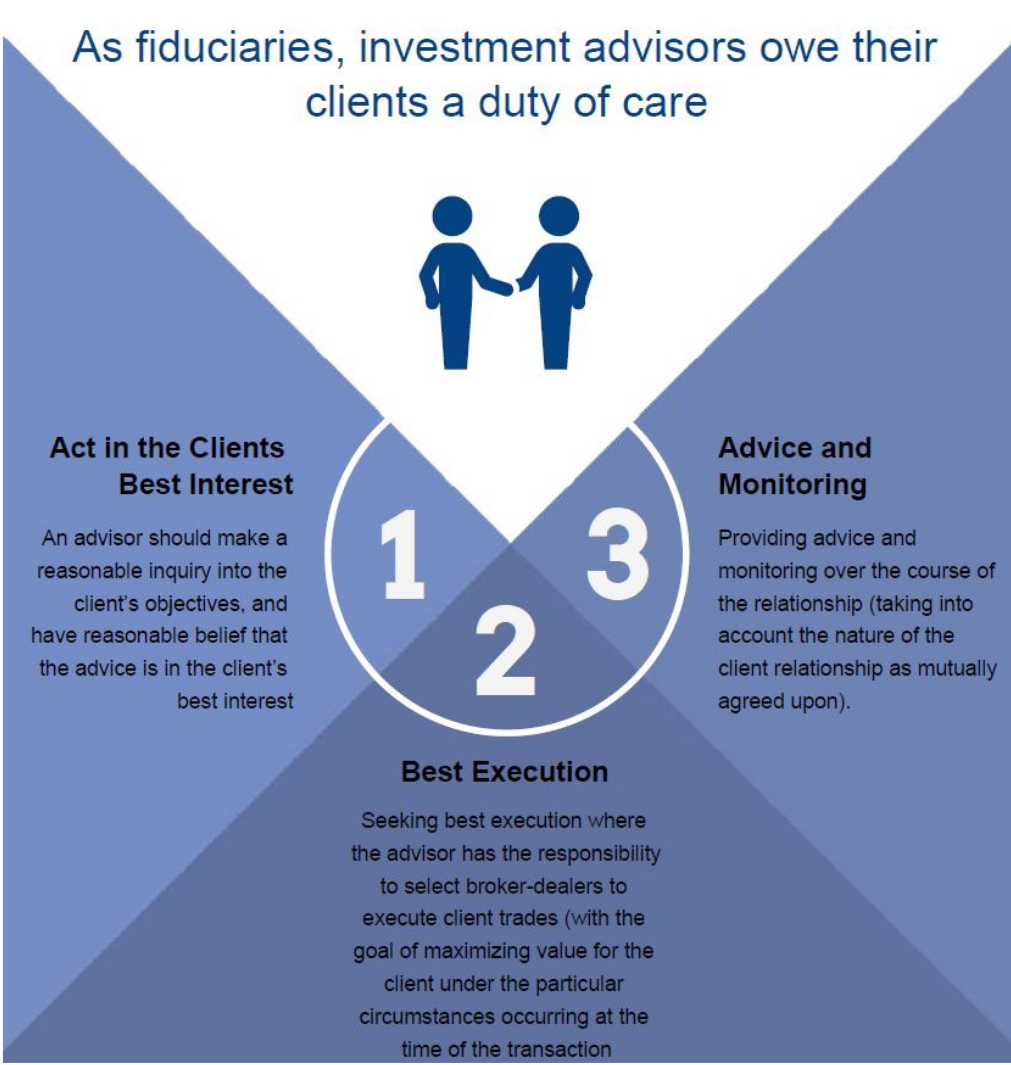

Fiduciary Duty consists of two fundamental components:

Duty of Care and Duty of Loyalty.

- Duty of care is the obligation to provide advice in the client’s best interest.

- Duty of loyalty is the obligation to not subordinate client interests to the advisor’s own interests.

You wouldn’t want your doctor making commissions on the drugs prescribed to you, so why would you want your advisor to make commissions on advice given to you?

What You Can Expect From

Ogorek Wealth Management, LLC

Performs ongoing management and oversight

Does not sell insurance or investment products

Follows fiduciary standards

Must disclose any conflicts of interest

Regulated by the U.S. Securities and Exchange Commission (SEC)

Makes recommendations that are always in the clients' best interest

How To Know If You Are Working With A Fee-Only Fiduciary Advisor

1. Is a Registered Representative a Fiduciary?

Not always since they represent a Broker-Dealer, which is engaged in the sale of security products (such as stocks, bonds, mutual funds, etc).

2. Does holding a Series 6 or Series 7 Security License mean someone is a Fiduciary?

Not always since they can be fiduciary, but these are licenses to sell mutual funds and general securities to you.

3. At the bottom of an advisor’s website, do the words “securities offered through” indicate that they are a Fiduciary?

This means they are licensed to sell you securities through a Broker-Dealer who pays them a commission for their efforts.

4. Is an advisor dually registered with FINRA and the SEC?

Fee-only registered investment advisors are routinely examined by the U.S. Securities and Exchange Commission (“SEC”) to uphold the Fiduciary Standard. Believe it or not, “dually registered” firms are able to claim that they are Fiduciaries, while also being in a position to sell you investments or insurance products.

5. Does the advisor follow Fiduciary or Suitability Standards?

The fiduciary standard requires RIAs, like Ogorek, to only make recommendations that are in the client’s best interest. The suitability standard requires only that investments be suitable to the investor’s circumstances, and may allow a broker to recommend an investment that is more costly and generates a higher commission than a similar low-priced option.

6. Is the advisor a member of NAPFA and CFP board?

In addition to SEC standards, NAPFA and the Certified Financial Planner (“CFP”) Board monitor and enforce their own, often higher, standard of interpretation of the term “fee-only advisor.” Members of NAPFA or CFP need to fully understand these organizations position on “fee-only advisors” to avoid a violation of their standards. NAPFA members are fee-only advisors and cannot accept third party payments.