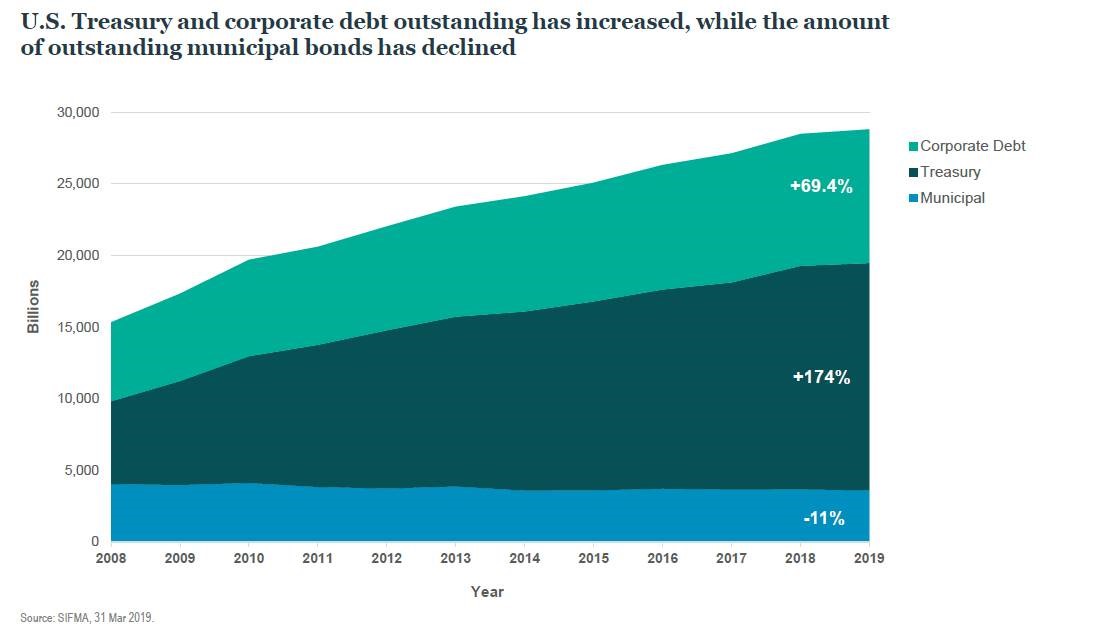

The below chart from Nuveen shows a fascinating trend in bond markets occurring over the last ten years: while the supply of U.S. Treasury and Corporate debt has increased by 174% and 69%, respectively, the supply of outstanding Municipal Debt (Issued by States and Local Municipalities) has shrunk by 11%.

Economics 101 tells us that lower supply (all else equal) will result in higher prices. And that’s just what’s happened, as Municipal bond returns have outpaced taxable bond returns over the last ten years (4.1% to 3.9%). That shouldn’t happen, as the yield component of Municipal bond returns is also exempt from Federal taxes, making those returns even more appealing on an after-tax basis.

Source: Nuveen

PLEASE SEE IMPORTANT DISCLOSURE INFORMATION HERE.